How Data & AI Will Shape Micro-Market Decisions: Site Selection, Pricing & Demand Forecasting

Data has quietly become the new land bank in Indian real estate. As homebuyers scroll through portals, investors benchmark yields across cities, and regulatory scrutiny tightens, developers who still “go by gut feel” on where to buy, what to launch, and how to price are discovering they are competing against players armed with dashboards, models and machine-learning engines. In a market expected to grow to around 5.8 trillion US dollars by 2047 and contribute more than 15 per cent of India’s GDP, the penalties for getting a micro-market call wrong – on land, launch timing or ticket size – are now simply too large to ignore. Over the last decade, the story of Indian real estate has shifted from “which city” to “which micro-pocket within that city”. In markets like MMR, NCR, Bengaluru or Hyderabad, a three-kilometre difference in location can mean a completely different buyer profile, price band and absorption curve. That is why developers and institutional investors are now treating micro-market calls as strategic capital allocation decisions rather than routine site picks. National Housing Bank’s RESIDEX index shows all-India housing prices rising about 6.8 per cent year-on-year in the September 2024 quarter. Still, city and sub-city trends diverge sharply, with some corridors recording double-digit annual growth and others stagnating. For any serious player, the question is no longer “Should we be in Pune or Ahmedabad?” but “Which exact corridors, price points and product mixes within those cities will compound value over the next five to seven years?” At a basic level, micro-market selection has shifted from “where sentiment is good” to a multi-layered data stack. Developers now blend: Price indices and trend lines from NHB‑RESIDEX and official statistics to understand cyclical behaviour. Absorption, launch and “quarters-to-sell” metrics from research houses such as Knight Frank and JLL. Registration and listing data from portals to gauge on-ground traction and price realism at a granular level. Knight Frank’s India Real Estate market reports highlight how developers now track not just city-level consumption, but also micro-market outperformance – for example, specific zones in Thane, Whitefield or North Bengaluru where three-year absorption growth has far exceeded city averages. This lets them avoid over-supplied belts while doubling down on underserved lifestyle or affordability niches. A big leap in Indian micro-market analysis is the use of geospatial tools. Instead of treating a pin code as a uniform market, data teams now overlay commute-time heatmaps, infrastructure projects, and social amenity clusters to understand true liveability at a micro level. Proptech analyses of Indian valuation models note that these location features feed directly into machine-learning algorithms that predict price and absorption, capturing non-linear premiums for walkability, metro proximity and social infrastructure that traditional spreadsheets often miss. For a developer evaluating two parcels in the same corridor, such tools can reveal that one site has significantly greater long-term pricing power due to superior connectivity and amenity clustering, even if today’s ticket sizes look similar. Institutional investors and larger developers increasingly run prospective projects through investment dashboards. These platforms blend historical absorption, resale velocity, rental yields and price volatility with external datasets such as income growth or IT hiring trends to score each micro-market. Research on capital flows into Indian real estate shows that global investors are particularly sensitive to such quantified micro-market stories, demanding evidence on residential demand depth, affordability and regulatory stability before committing capital. Developers who can show data-backed narratives on why a specific corridor can sustain particular price bands and inventory levels, therefore have a distinct edge in raising funds and structuring joint ventures. If data helps answer “where” to play, AI is transforming “how” to price within those markets. Globally, the AI-in-real-estate market is estimated at just over 300 billion US dollars in 2025 and is projected to grow at more than 34 per cent annually, driven by valuation engines, recommendation systems and risk models. India shares this trajectory as portals, proptechs and developers experiment with AI-led pricing and benchmarking. Commentary on Indian applications notes that machine-learning models such as random forests and gradient boosting generally deliver more accurate price predictions than traditional linear regressions, especially where infrastructure, brand and configuration interact in complex ways. For developers, this means pre-launch pricing can now be set using probability-weighted scenarios: what happens to sales velocity and margin if base prices are 5–10 per cent higher or lower than the AI-estimated fair value across different unit sizes. AI also strengthens benchmarking. Instead of manually scanning a limited set of comparable projects, developers can query models trained on hundreds of launches across India’s top cities, segmented by micro-market, configuration, brand, amenity set and possession timeline. Analyses of Indian price indices explain how developers overlay these model outputs with city-level and national data to avoid misreading local peaks and troughs. For premium launches, particularly in emerging corridors, teams now triangulate three numbers: AI-estimated fair value, historic and projected appreciation trends, and business-plan requirements on margin and payback. The chosen pre-launch price usually sits within a band where demand models still show healthy absorption while long-term investors can see room for capital appreciation. Dynamic pricing – adjusting rates over the life of a project – is still in its early stages in Indian housing, but AI is enabling more nuance than the traditional “increase per slab” approach. Market studies on AI in real estate note that revenue-optimisation engines can ingest live enquiry data, booking velocity, inventory age and competitor moves to suggest micro-changes in pricing or payment schemes, rather than blunt festive discounts. In practical terms, that might mean nudging up prices for specific stacks or views that show unusually high conversion, offering limited-time payment flexibility on slow-moving configurations instead of cutting rates across the board, or repositioning a tower based on observed buyer response to unit sizes and layouts. Such tools do not replace the sales team, but they give sales leaders data-backed guardrails on where they can push and where they should hold. Beyond pricing, AI is reshaping how developers think about how much to launch, when to launch it and how fast they can realistically sell. Demand forecasting models built with machine-learning techniques can combine macroeconomic indicators, city-level absorption data, internal CRM feeds and external digital signals such as search trends and portal traffic. Studies on AI’s implications for real estate highlight that these models often outperform traditional time-series forecasting, especially in volatile or recovering markets. For Indian developers, this translates directly into better decisions on tower sequencing, launch volume and marketing intensity, particularly in large townships or multi-phase projects where phasing can make or break project economics. Inventory risk remains a central concern for Indian developers, even though unsold stock has moderated from earlier peaks. Knight Frank’s tracking of “quarters-to-sell” shows that while absorption has improved in many key markets, a misjudged launch scale can still lock up capital for years. AI-assisted absorption models help answer questions such as whether phase one should be 300 units or 600 units, how changes in configuration mix will affect sell-through and cash flows, and what happens to payback if interest rates rise or a competitor launches a similar product sooner. By running many scenarios, these models show developers not only the most likely outcome but also the downside tails, helping management teams and lenders understand where risk truly sits. This is particularly relevant for large integrated townships and plotted developments, where poor phasing can create half-empty communities and drag down brand perception. India’s AI–proptech ecosystem has expanded sharply in the last few years, with global reports identifying India as a key growth geography for AI in real estate because of its scale, urbanisation and digital adoption. On the ground, the typical stack blends macro and regulatory data from housing finance and central bank sources, city and micro-market analytics from international property consultancies, transaction and enquiry datasets from domestic property portals, and in-house CRM and channel partner data. Machine-learning then sits on top of this, powering everything from valuation engines and recommendation systems to lead scoring and churn prediction. The biggest unlock often comes not from exotic algorithms but from the discipline of cleaning, standardising and integrating data across departments so that micro-market, product and pricing discussions happen off a single, consistent view of reality. Ultimately, data and AI are forcing a cultural shift in how Indian developers and investors make decisions. The India Brand Equity Foundation projects that real estate’s share of GDP will more than double by 2047, underlining how much capital and responsibility the sector will carry in the coming decades. In that context, instinct will always have a role – but instinct is calibrated and tested against robust data and predictive models. For premium developers, this means using micro-market analytics to prioritise truly scalable corridors, letting AI-informed pricing and phasing decisions protect margins without over-stretching demand, and building internal capabilities so every major decision on land, launch, product and price can be defended with clear, quantified logic. In a market where buyers, lenders and global partners are becoming more sophisticated, the competitive edge will increasingly belong to those who can combine the old strengths of Indian real estate – intuition, relationships, execution – with a new, disciplined layer of data and AI-powered foresight. Why micro-markets are the real battleground

Data as the new micro-market due diligence

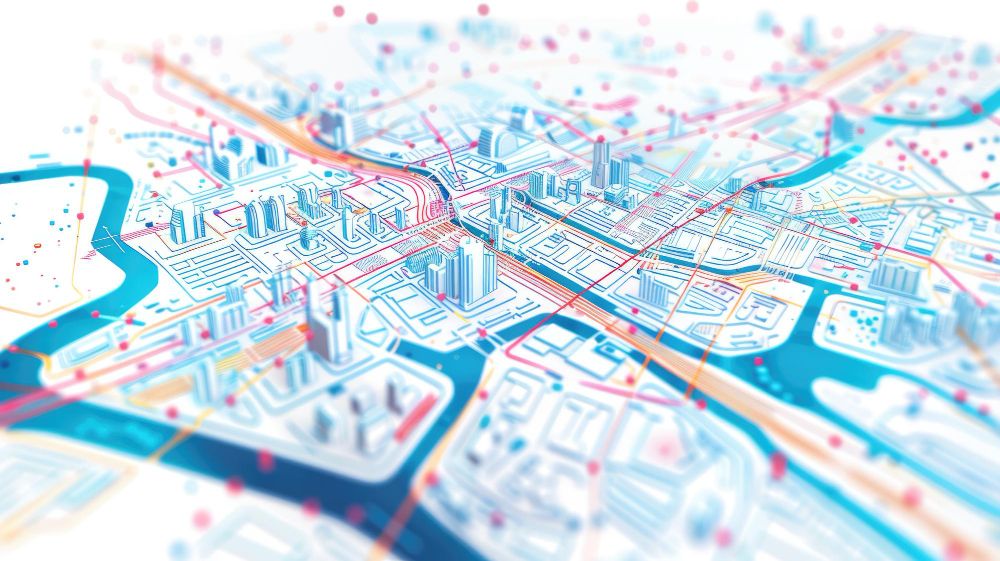

Geospatial intelligence: mapping reality, not just pin codes

From dashboards to decisions: how investors use data

AI’s impact on pricing strategy

Pre-launch and benchmark pricing in practice

Dynamic pricing and revenue optimisation

AI-enabled demand forecasting and absorption modelling

Phasing, construction strategy and risk reduction

The emerging Indian AI–AI-proptech stack

A new decision culture for Indian real estate